Fact Sheet: Growing Number of States Boosting Affordable Housing Supply through HUD Risk-Sharing

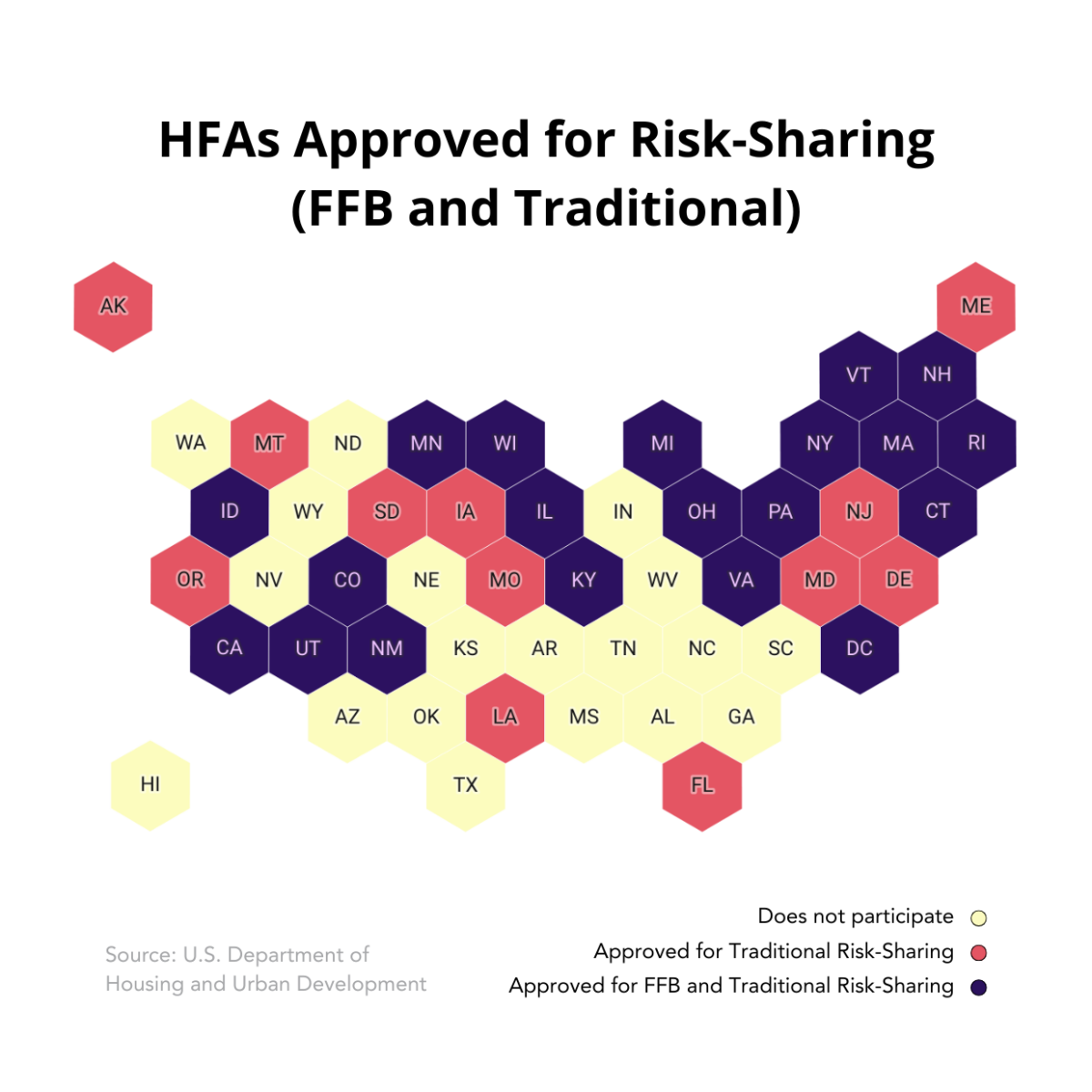

A growing number of states and local housing finance agencies are utilizing the Federal Financing Bank (FFB) Risk-Sharing Initiative, an existing commonsense tool requiring no Congressional appropriations, to access the capital needed to build and preserve affordable housing supply. Today, 38 housing agencies from 34 states are approved to use the Risk Share program.

The following Fact Sheet is the first in a forthcoming series of NAAHL resources aimed at making plain the housing supply levers and solutions — existing and new — as we confront the rising cost of housing across America.

This first fact sheet was prepared in collaboration with the National Council of State Housing Agencies. Together, our two organizations represent the FFB Risk-Sharing Working Group, a coalition of national, state, and local nonprofit and public sector partners committed to expanding the affordable housing supply through the FFB Risk Sharing Program.

FFB + Traditional Risk-Sharing

California HFA

Colorado HFA

Connecticut HFA

DC HFA

Idaho HFA

Illinois HDA

Kentucky Housing Corp

Massachussetts HFA

Mass. Housing Partnership

Michigan HDA

Minnesota HFA

Montgomery Co. HOC

New Hampshire HFA

New Mexico MFA

New York City HDC

New York State HFA

Ohio HFA

Pennsylvania HFA

Rhode Island HMFC

Utah Housing Corp

Vermont HFA

Virginia HAD

Wisconsin HFDA

Traditional Risk-Sharing

Alaska HFC

Delaware State HA

Fairfax County RHA

Florida HFC

Iowa HFC

Louisiana HFA

Maine HFA

Maryland DHCD

Missouri HDC

Montana BOH

New Jersey HMFA

Oregon HCSD

Philadelphia RA

South Dakota HDA

Unlocking Supply, Lowering Costs: The Federal Financing Bank (FFB) Risk-Sharing Initiative

The FFB Risk-Sharing Initiative, a joint effort by HUD and the Treasury Department, helps states and local housing agencies finance affordable housing more quickly and affordably. By allowing housing finance agencies to originate FHA-backed multifamily loans with shared risk, the program lowers borrowing costs, supports smaller and rural projects, and expands access to capital—all at no cost to taxpayers. The Risk-Share program is a negative-subsidy resource, and FFB provides unsubsidized at-cost capital to housing agencies.

Program Highlights

Advances supply-focused housing solutions: Helps states finance new affordable housing without relying solely on tax-exempt bonds or competitive LIHTC awards.

Delivers lower-cost financing: FFB purchases reduce capital costs and stretch public dollars further.

Serving rural areas: Offers small and rural HFAs a reliable financing alternative comparable to Ginnie Mae pricing.

Actively supporting housing supply: The Risk-Sharing Initiative is actively supporting deals in the current pipeline and providing confidence to lenders and developers.

Risk-Sharing Impact*

$23.6 billion+ invested through Risk-Sharing since 2001

247,000+ affordable rental homes financed or refinanced through Risk-Sharing

101 loans in FY 2024 alone, supporting over 9,265 units

Additive FFB Risk-Sharing Impact*

$7.03 billion in FFB Risk-Sharing loans committed since program inception

56,000+ affordable rental homes financed using FFB Risk-Sharing.

*Statistics reflect data on firm commitments as of Q1FY2026.